5 ways to Manage your Freelance Finances

Categories

Pro Tips

Business

Author

Lee Barguss

Published

7 Apr 2020

Working as a freelancer doesn’t mean that you only need to know your trade. It also means you need to know how to run a business, and finances are one of the core fundamentals of any business management.

It’s not always easy to be on top of your finances, especially if your work takes priority and a business-running mindset is a second thought. However, if a business can’t sustain itself, you won’t be able to continue with it.

Since most of us aren’t trained and qualified in finance and accounting, and if your business isn’t making thousands of pounds every month, you can easily do it yourself! So I’ve gone ahead and compiled a list of my top tips to help any business owner make easy work of their ins and outs through the year.

1. Open Multiple Bank Accounts

For most countries, it’s either free or really cheap to open a bank account. Whilst you could do everything from one account, it makes it a little more complicated to keep track of everything.

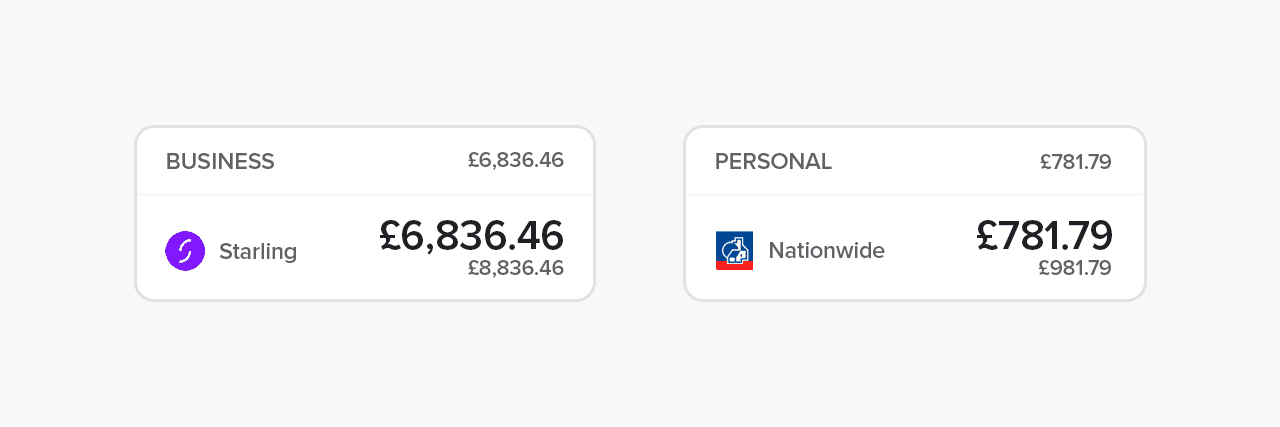

So, to make things simpler I would recommend that you split your finances into two separate banks accounts at the very least – one for your business finances and the other for your personal finances. This way, when it comes around to doing your taxes, everything you need will be in one place.

Any money that comes in from work will come into your business account, and when you need to take your wages, just transfer it to your personal account.

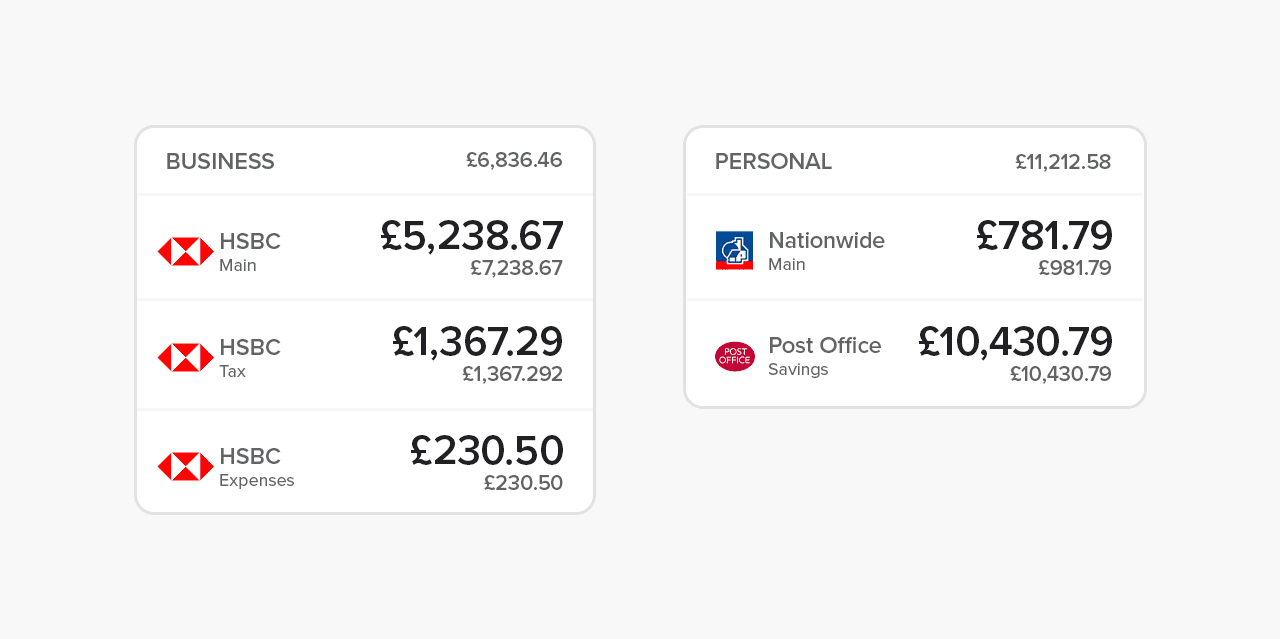

Personally I find it better to break the bank accounts down even further to help manage my money even further. My Business account contains the following;

Main account

Tax account

Expenses account

and my Personal account contains;

Main account

Savings account

For example:

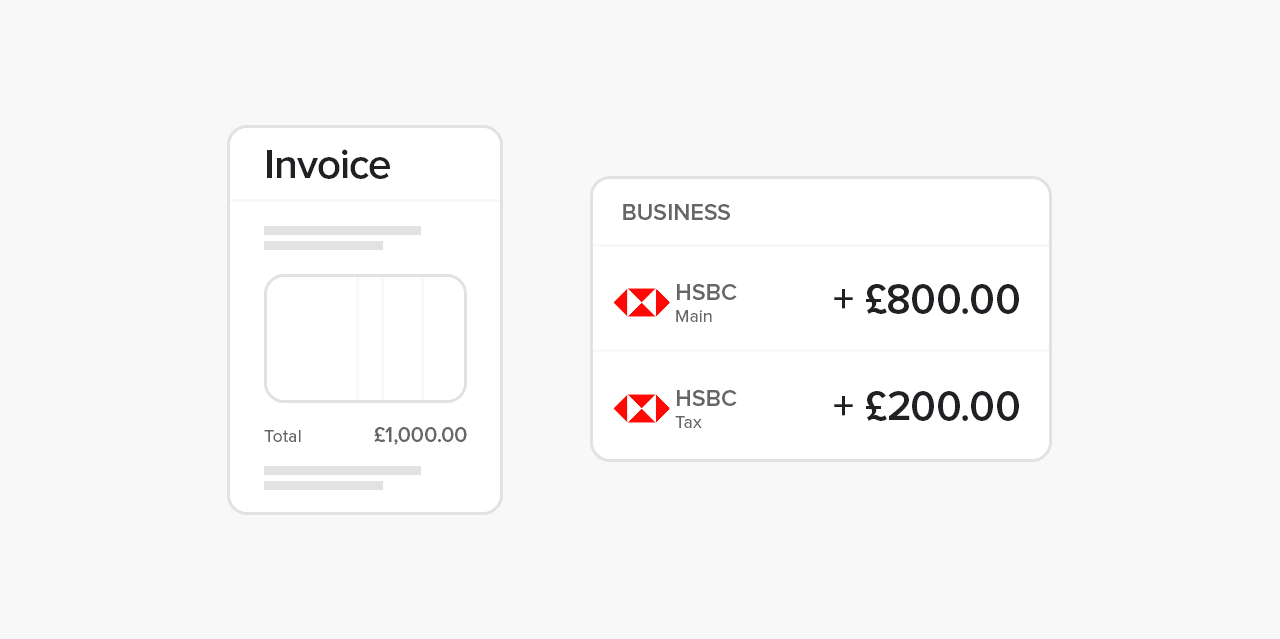

Long story short, invoice payments will arrive in my Main Business account, a slice will get transferred to the Tax account as soon as possible (more about this later), and then another slice will then go to the Expenses account.

When it comes to paying myself, I usually take a “wage” that covers my personal expenses such as groceries, bills and subscriptions etc., and I then put a percentage of that into my Savings account.

2. Set Aside for Taxes

This section will apply differently depending on where you are tax resident, but for this example, let’s say we’re in the UK. We’re lucky enough to have a Personal Allowance, which means we don’t pay tax on (at the time of writing) the first £12,500 of our income, then 20% for income thereafter, and so on…

My Tax account is set up specifically to store the money I need to pay to the tax man. A habit I’ve set is to store 20% of every payment I receive in this account so it can cover the 20% rate of income tax I need to pay after the £12,500 threshold, as well as my National Insurance (NI) contributions, and a little extra for emergencies or debt reserve. So if someone pays me £1,000, I’ll move £200 straight away to this account.

As most of this money isn’t technically mine (it’s the government’s), I shouldn’t spend it or touch it – which is why it has its own account. If at the end of the year you don’t have enough money to pay your taxes, you’ll likely be fined and have to pay some interest so it’ll end up costing you more.

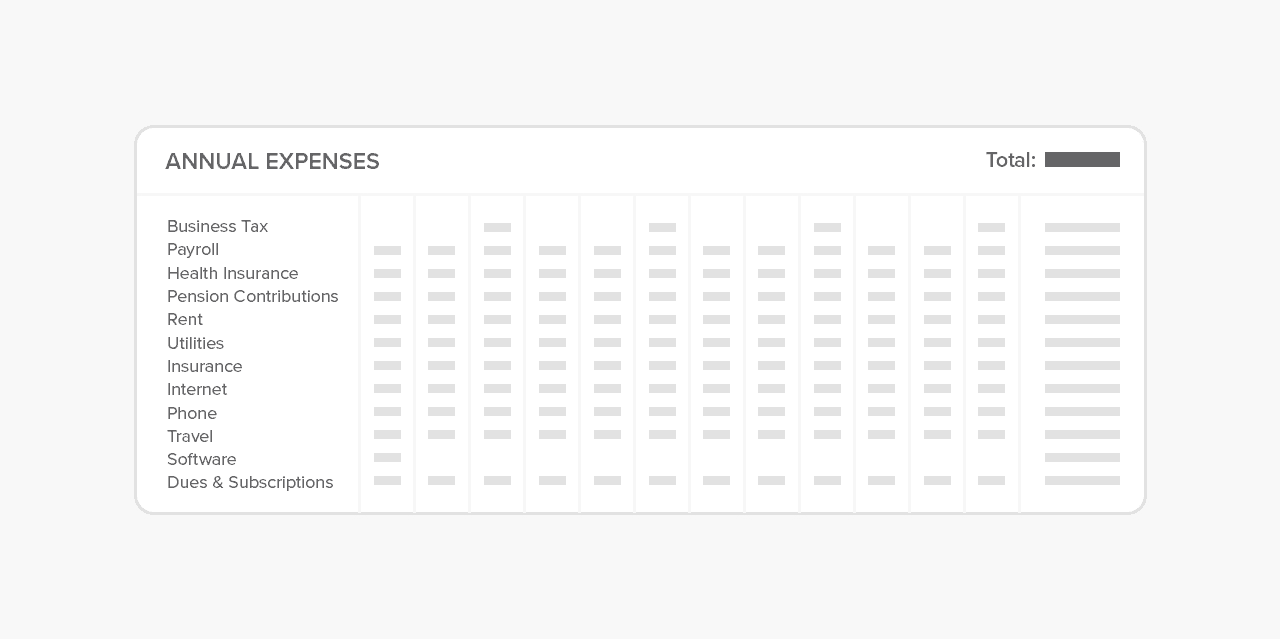

3. Set up an Expenses Plan

An Expenses plan is all about knowing and understanding what money needs to go out your of your business in order to keep it running. This will be anything from software, subscriptions, insurance, equipment and supplies, rent, utilities, phone bills etc.

My Tax account is set up specifically to store the money I need to pay to the tax man. A habit I’ve set is to store 20% of every payment I receive in this account so it can cover the 20% rate of income tax I need to pay after the £12,500 threshold, as well as my National Insurance (NI) contributions, and a little extra for emergencies or debt reserve. So if someone pays me £1,000, I’ll move £200 to straight away this account.

As most of this money isn’t technically mine (it’s the government’s), I shouldn’t spend it or touch it – which is why it has its own account. If at the end of the year you don’t have enough money to pay your taxes, you’ll likely be fined and have to pay some interest so it’ll end up costing you more.

4. Monitor and log your Books Regularly

Keeping an eye on your spending will ensure it doesn’t get out of hand, so a great way to handle it is to create a routine for yourself. A good habit is to log your books every month (you could even do every day if you wanted), but I’m personally happy to run over my books around twice a month – during the first and third week of every month.

Managing money is a different experience for everyone, but it’s one of the most important aspects of a business. You just need to find your way of doing it, learn it and stick to it. There are plenty of options when it comes to accounting software online that let you log everything you spend, set you up with invoicing, and even help you with payrolls.

Some great examples of software that I’ve come across and used include Waveapps, Quickbooks and Xero. Their pricing does vary, but depending on what level of complexity your business accounts follow, at least one of these will do the job well. If you are already partnered with an accountant, they will require proof of purchase for everything business-related. With the above apps, you can take photos of receipts and upload them to the software for your accountant to approve.

If apps like these don’t fit the way you manage your money, you can also use software like Microsoft Excel to make complicated tables and formulas, or software like Zoho where you can build your own accounting software. These can be a lot more complicated than accounting software, but the end result could match your needs more perfectly than any apps made for masses.

5. Setup a Strong Invoicing System

As business owners, something we all have to deal with is sending out invoices and chasing them up when a client is late paying. It’s not always as simple as finishing a job, sending out an invoice and being paid the next day – although that would be nice! So, what can we do to make the payment process as simple as possible to get paid on time and therefore pay your own bills on time?

The main reason to set a due date on an invoice (of course) is to encourage your client to pay within a reasonable timeframe. Working with different kinds of clients you’ll easily see different due dates on invoices such as first Monday of the month, end of the month etc, but a standard is 30 days. My go-to is 21 days – it’s unexpected but still enough time to organise payment of an invoice.

Between sending out your invoice and the due date, it will be important to send reminder emails just to make sure your clients haven’t forgotten about you. It’s easily done! How many you choose to send is totally up to you. However, you don’t want to annoy your clients by blitzing them, so it’s good to figure out a system that works for you and stick to it. A plan that works really well for me is a total of 4 emails over the 21 day period:

Email 1

Includes your invoice and outlines key info so your client can see everything at a glance – invoice number, amount, due date etc.

Email 2

Send halfway between invoice date and due date (Day 10 or 11 in this case). A quick reminder with invoice number, due date and how long they have left to pay.

Email 3

Send a few days before the due date. A quick reminder with invoice number, amount due and how long they have left to pay.

Of course, you’re bound to get the occasional client who doesn’t pay on time or have payment terms of their own that need to be abided by, so in these cases, you’ll have to play it by ear do your best to come to a mutual arrangement. This might be something like agreeing to waive late payment fees if your client pays within a week of your due date, if they’re really not able to on time. Besides, being flexible (to some extent) might mean a great working and long-term relationship with your client.

Owning your own business can be advantageous and worthwhile, only if you’re able to sustain it and maintain a healthy cashflow. You don’t need an education in finances to manage your money. Just remember to:

Spend less than you earn

Keep an eye on what’s coming in and going out

Set aside for taxes and expenses

Find and use the right financial tools for you

Save for emergencies